We are at mid-year, a good time to check in and see how we are doing on a number of fronts – including where we are with new drug approvals. Over the years, Congress has acted to enhance the ability to bring more new treatments from test tube to medicine chest more quickly. Most notably in 2012 the Food and Drug Administration Safety and Innovation Act (FDASIA) was signed into law, bring to bear among other things, breakthrough therapy designation. Since that time, there has been a healthy output of new treatments.

But recently in the larger environment, there have been several factors that may have inhibited the flow of the medicine pipeline. The most obvious impact is that of COVID-19 to recruiting and maintaining clinical trials. And then there is the fact that a number of clinical trials were being conducted either in Russian or in Ukraine prior to the outbreak of the war. On top of that, COVID-19, while representing a good deal of medical progress, also represents a tremendous diversion of resources in time, money and effort that might have been otherwise utilized. Finally, COVID also impacted FDA’s ability to manage the regulatory process itself. Advisory committee meetings have been far fewer and observationally speaking, FDA seems to be extending PDUFA dates quite regularly.

So how are we doing? There are a few things to look at.

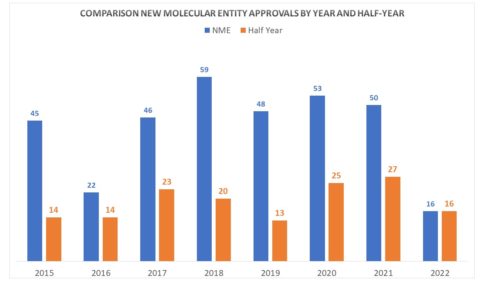

- New Molecular Entity Approvals – The most obvious is to see how we are doing on new molecular approvals – those approvals representing entirely new treatments. Looking at past years and where we were at the mid-year point and where we ended up each year, can give us some insight into this year. The news is not so hot. By the end of June this year, FDA had approved only 16 novel drugs. By this time last year, there were 27. Below is a chart that compares year by year the rate of novel approvals as of the end of April and by the end of year.

This is not to say that the balance of the year might not make up for the slow first half. by mid-year 2019, there were only 13 approvals of new entities but the year netted out with a respectable 48. It all depends on what’s in the pipelineSo let’s look at PDUFA dates.

2. PDUFA Dates– PDUFA dates are proprietary and FDA does not publish a list of upcoming dates. Still, one can compile a list by capturing public announcements of new drug or biologic applications with FDA, many of which mention the specific PDUFA date and many that allow a guess based on counting from the date of a press release. Subtracting out applications for supplemental applications, there do not appear to be an overwhelming number of upcoming dates, which might undermine any recovery in the second half of the year to a more robust number of approvals of new molecular entities.

3. AdComms – Finally, as noted in a prior posting, the number of advisory committee meetings that FDA has been holding has diminished considerably overall. That means that the agency is utilizing outside counsel less frequently, perhaps due in some part to the advent of breakthrough therapy designations which means that the agency is having a higher level of interaction with drug sponsors that may negate the need for an AdComm. But one could also surmise that AdComms are reserved for circumstances where FDA wants outside counsel because an investigative compound is exploring new territory. In any case, the only recent advisory committee was one of the Cellular, Tissue, and Gene Therapy Advisory Committee which by its nature, is likely to be in regard to a new molecular entity.

In short, the outlook for output this year does not appear at this juncture to be promising. But there are many moving parts and when and if they do move, it can change the picture considerably. Certainly there have been years past where at mid-year, there was not a robust output, but which ended up much improved over the final half of the year.